Middle East Country Will Be the Big Volume Buyer

Saudi Arabia is expected to be the big volume buyer in the Middle East. The kingdom’s purchasing power significantly influences regional markets.

As a pivotal player in the Middle Eastern economy, Saudi Arabia’s investment and procurement strategies often set trends for neighboring countries. The nation’s focus on diversifying its economy and reducing reliance on oil revenues has led to substantial investments in infrastructure, defense, and technology.

These sectors are drawing considerable international interest, with companies vying to meet the increased demand. Understanding Saudi Arabia’s buying patterns is crucial for businesses aiming to enter or expand within the Middle Eastern market, as their purchasing decisions can signal emerging economic priorities and opportunities in the region.

Middle East’s Economic Expansion

Diversifying From Oil Riches

Middle Eastern economies historically relied on oil. Now, they reach beyond it. Nations adopt new strategies. They embrace industries like tourism, finance, and technology. Diverse economies stand stronger. They create new jobs. They open doors for innovation. These countries invest in education and business. The goal is clear: a future beyond oil.Investment In Infrastructure

Infrastructure growth fuels economic expansion. The Middle East knows this. Billions pour into constructing ports, roads, and airports. Cutting-edge smart cities rise from the desert. These investments improve life quality. They make trade easier. They attract tourists. They invite global businesses. A modern infrastructure lays the foundation for a booming economy.- High-speed rail networks connect cities and markets.

- Upgraded ports accommodate larger volumes of goods.

- Energy projects harness solar power, showing a commitment to sustainability.

| Project Type | Examples in the Middle East | Expected Impact |

|---|---|---|

| Transport | Etihad Rail, Dubai Metro | Connectivity boost |

| Commercial | Mall of Saudi, Reem Mall | Retail growth |

| Residential | Lusail City, The Line | Housing revolution |

Investment Trends In The Middle East

Real Estate And Construction Boom

Cities like Dubai and Doha are in the midst of a construction renaissance. Projects range from residential properties to grand commercial complexes. This boom creates ample opportunities for investment.- Luxurious property developments are on the rise.

- Infrastructure projects are expanding urban horizons.

- Tourism growth fuels resort and hotel construction.

| Project | Location | Type |

|---|---|---|

| The Tower | Dubai | Mixed-use |

| Lusail City | Doha | Smart City |

| Neom | Saudi Arabia | Technology Hub |

Technology Sector Surge

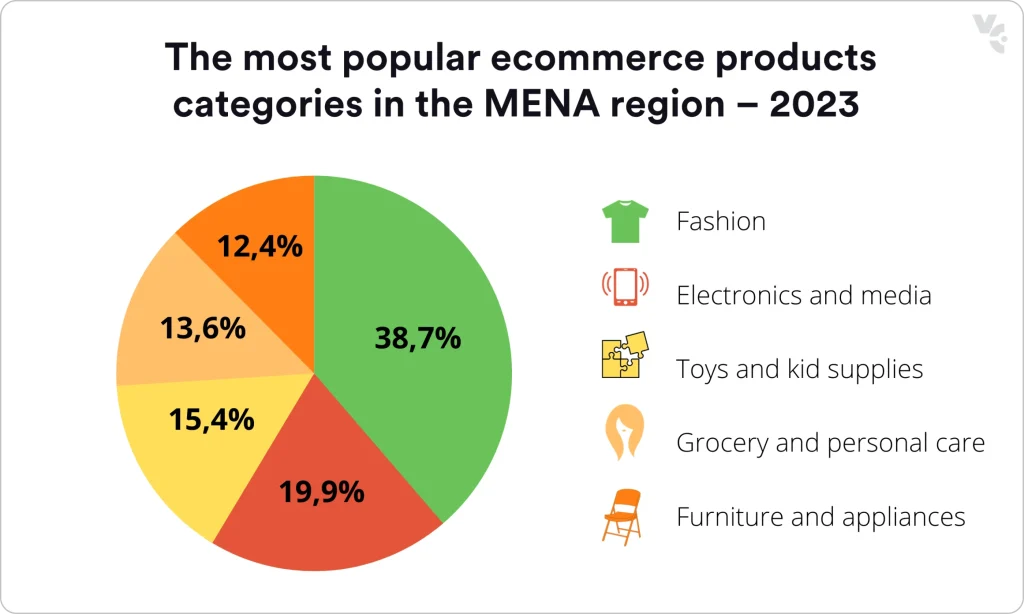

Driven by innovation and fintech, the technology sector is booming. Tech startups are gaining traction, backed by significant capital injections.- E-commerce platforms see record-breaking sales.

- Local IT firms are expanding services region-wide.

- Government support strengthens tech infrastructure.

Middle East Country Will Be the Big Volume Buyer

Key Industries Attracting Middle Eastern Capital

Renewable Energy Investments

Middle Eastern investors recognise the need for sustainable energy. Countries in this region have vast solar and wind potential. Investments in this sector are climbing.- Solar power projects attract heavy funding.

- Wind farms see increased capital allocations.

- Focus on green technology innovations grows.

Healthcare Sector Growth

Quality healthcare is vital. The Middle East injects capital into this sector. Investments aim to broaden access and enhance medical technology.| Area | Investment Impact |

|---|---|

| Hospitals | Expansion and modernization |

| Research | Advances in medical science |

| Health Tech | Innovative patient care technologies |

Credit: carnegieendowment.org

Role Of Sovereign Wealth Funds

Strategy And Economic Impact

Sovereign Wealth Funds plan for long-term growth. They focus on economic diversification. Funds channel into various sectors. Technology, real estate, and infrastructure are a few examples. They prioritize stability. Financial returns are essential. Yet, SWFs aim to shield economies from market volatilities too. They often act as a buffer. They preserve wealth for future generations. National objectives guide these investments. Economic impact ripples through job creation and technological advancement.- Broadening economic horizons

- Reduction of dependency on oil

- Enhancing financial resilience

- Job creation in new industries

Major Acquisitions

Middle Eastern SWFs have made headline-grabbing acquisitions. This strategy strengthens economic clout globally. Big buys involve leading companies and high-value assets. They span multiple sectors. These bold moves signal confidence. SWFs show sophistication in investment decisions. The table below highlights key acquisitions.| Fund | Acquisition | Sector |

|---|---|---|

| Qatar Investment Authority | Harrods Group | Retail |

| Abu Dhabi Investment Authority | Hyatt Hotels | Hospitality |

| Public Investment Fund | Uber Technologies | Transport Technology |

| Kuwait Investment Authority | Mercedes-Benz | Automotive |

Impact Of Global Trade Dynamics

Trade Agreements And Partnerships

Middle Eastern countries craft smart alliances. They work on deals that open markets. This brings mutual growth. Two countries may shake hands. This means more goods flow. It creates a win-win situation for both.- Bilateral agreements: These are one-on-one deals. They help in cutting costs and red tape.

- Regional partnerships: These involve multiple countries. They aim to smoothen trade over areas.

- Free trade zones: These areas have less tax. They attract companies. They also make trade easier.

Responses To Tariffs And Trade Barriers

Trade barriers can slow down buying. But the Middle East adapts quickly. They negotiate to lower these hurdles. Alternatives are also on the table.| Tactic | Purpose |

|---|---|

| Negotiating | Making better rules for trade |

| Diversifying | Buying from different places |

| Seeking alternatives | Finding new ways to trade |

Credit: www.wsj.com

Consumer Behavior And Retail Market

E-commerce And Online Shopping Trends

Online shopping is taking the Middle East by storm. With a tech-savvy population, consumers are leveraging digital platforms to make their purchases. High-speed internet has made e-commerce sites and shopping apps more accessible. As a result, traditional retail must adapt to stay relevant. Recent years have seen a surge in:- Mobile commerce, with shoppers buying directly from smartphones.

- Online marketplaces gaining traction over single-brand websites.

- Preferred payment methods skewing towards digital wallets and card payments.

Luxury Goods And Services Demand

In the Middle East, luxury goods are more than a purchase; they’re an experience. Retailers are noticing a consistent demand for high-end products. Luxury shoppers seek exclusivity and distinction. This group values brand heritage and quality craftsmanship.| Product Type | Consumer Interest |

|---|---|

| Designer Apparel | Remains strong |

| High-End Electronics | Surging |

| Luxury Vehicles | Stable growth |

The Future Of Automobile Industry Sales

Electric Vehicle Market Penetration

Electric vehicles (EVs) represent modernity in motion. Bold sustainability goals incite an EV revolution. Middle East buyers show growing interest in eco-friendly options.- Government incentives boost EV sales.

- Charging infrastructure expands rapidly.

- Local automakers launch new electric models.

Public Transport Infrastructure Plans

Public transport gets a major push. Ambitious projects unfold across the Middle East. They transform the region’s mobility landscape.| Country | Project | Completion Year |

|---|---|---|

| UAE | Metro Expansion | 2025 |

| Saudi Arabia | High-Speed Rail Network | 2030 |

| Qatar | Bus Rapid Transit | 2022 |

Agricultural Development And Food Security

Investments In Agri-tech

Technological advancements play a pivotal role in transforming agriculture. The Middle East is investing heavily in Agri-Tech to overcome environmental challenges. Innovative farming methods, such as hydroponics and vertical farming, are on the rise. These methods require less water and space, an important consideration in arid regions. Investments are not just in tech, but also in people, with many countries providing training for farmers to use these new tools effectively.Import Patterns And Self-sufficiency Goals

The region has long relied on food imports to feed its population. However, there’s a shift towards self-sufficiency. Many Middle Eastern countries are setting ambitious goals to increase domestic food production. They are analyzing import patterns to identify which crops to focus on. Adjustments in trade and tariff policies are also in play to favor local produce. This move towards self-reliance fosters a new era of food security in the region. Here’s a snapshot of these strategic moves:- Introduction of smart farming techniques to increase yield

- Setting up state-of-the-art greenhouse facilities

- Revising import tariffs to support local farmers

- Research and development in drought-resistant crops

Defense Procurement And Local Production

Military Modernization Programs

Middle East nations are pushing the limits. They want newer, better defense tools. It makes sense. The world is changing. They must keep up. They are investing lots. Some are replacing old equipment. Others are adding new power to their forces. The goal? Better security and upgraded capabilities.Collaborations With Global Defense Firms

These countries are not alone. They team up with big global firms. The aim? Boost local production. How? By sharing knowledge and resources. This way, they build a stronger defense. And, at the same time, they grow their own industries. It’s wise. It’s strategic. It builds local know-how and jobs.Technology Adoption And Smart Cities

Innovation Hubs In The Middle East

Innovation hubs are key to tech growth. The Middle East has many. These hubs create new jobs. They also attract investors. Cities like Dubai and Tel Aviv support start-ups. They offer spaces for ideas to grow. Tech events here draw global attention.- Dubai: Boasts tech-friendly policies for startups.

- Tel Aviv: Known for vibrant tech scene and skilled talent.

Smart Infrastructure Projects

Smart infrastructure is a big deal. The Middle East takes this seriously. Projects here include smart roads and eco-friendly buildings. Sensors and IoT devices help manage resources. This leads to smarter cities. Citizens enjoy higher living standards. Let’s explore some notable projects.| Project | Features | Impact |

|---|---|---|

| Neom | AI-driven city in Saudi Arabia | Revolutionizes urban living |

| Masdar City | Low-carbon development in UAE | Models sustainable design |

Oil And Gas Sector Adaptations

Post-peak Oil Economic Strategies

The Middle East gears up for a future beyond oil. Nations invest in technology, tourism, and renewable energy. They aim for economic diversity. This shift reduces their oil reliance.- Development of high-tech sectors

- Investment in solar and wind projects

- Promotion of medical and educational tourism

Natural Gas Market Dynamics

Natural gas emerges as a key player in energy. The Middle East taps into its vast reserves. They target big buyers with competitive pricing.| Country | Reserves | Export Plans |

|---|---|---|

| Qatar | World’s third largest | Expand liquefaction facilities |

| Iran | Rich in reserves | Joint ventures & export boosts |

Credit: www.latimes.com

Banking Sector And Financial Services Evolution

Fintech Initiatives

The region’s Fintech Initiatives transform how businesses operate. Mobile banking is now a staple. Easy payments are changing daily lives. Digital wallets grow popular. The customer experience is online-first, and cashless transactions are the new norm. Middle Eastern countries embrace these changes.- Digital-only banks are opening

- Payment gateways expand rapidly

- Blockchain starts to thrive, bringing security

Islamic Finance Growth

Islamic Finance sees rising acceptance. Interest-free solutions align with cultural beliefs. Sharia-compliant products please customers. Investment in Islamic fintech climbs. These solutions respect tradition. They offer modern banking perks. Below are key highlights of its growth:| Year | Market Size | Growth Rate |

|---|---|---|

| 2023 | $2.5 trillion | 10.5% |

| 2025 | Estimated $4 trillion | Anticipated 15% |

- Sukuk (Islamic Bonds) are more common

- Takaful (Islamic Insurance) gets attention

- Investment funds follow Sharia laws

Tourism Industry As Revenue Stream

Mega Projects And Entertainment Venues

Significant investments in mega projects reveal the Middle East’s ambition to captivate global tourists. These ventures are not just large in scale; they encompass a range of attractions from record-breaking skyscrapers to sprawling theme parks.- World’s tallest buildings

- Gigantic shopping malls

- A man-made archipelago

- Resorts with underwater rooms

- Interactive museums

- Global sports competitions

- Concerts by top artists

Cultural Heritage And Ecotourism

The region’s rich cultural heritage is a major draw. Countries are recognizing the importance of preserving history while making it accessible to tourists. Highlights include:- Ancient ruins

- Historical trade routes

- Traditional markets

- Desert safaris

- Mountain treks

- Protected marine areas

Education And Workforce Development

Investment In Higher Education

Higher education gets significant investment in the Middle East. New universities open their doors. Old institutions get state-of-the-art facilities. This means better research, better teaching, and brighter futures for students.- World-class universities attract international students.

- Research hubs foster innovation.

- Grants and scholarships make education accessible to all.

Skill Development For Diverse Economies

Middle East countries build economies not just on oil, but on knowledge and innovation. These countries understand that a skilled workforce is the strength that drives progress.- Vocational training in tech and green energy.

- Entrepreneurship programs empower new business leaders.

- Career centers provide guidance for emerging job markets.

Healthcare Infrastructure Modernization

Hospital Capacity And Service Expansion

To meet the growing demands of their populations, Middle Eastern countries are significantly expanding hospital capacities and services. Ultra-modern facilities are being built with cutting-edge technology to accommodate more patients. This expansion improves access to high-quality care.- New hospitals with larger number of beds

- Specialized centers for chronic diseases and emergencies

- Investment in state-of-the-art medical equipment

Telemedicine And Digital Health

The rise of telemedicine and digital health services is reshaping healthcare delivery in the Middle East. These technologies offer convenient access to care. They help patients manage their health anytime, anywhere.| Advancements | Benefits |

|---|---|

| Virtual Consultations | Quick access to doctors |

| Health Apps | Track and manage personal health data |

| Remote Monitoring Devices | Continuous patient monitoring |

The Role Of Public-private Partnerships

Infrastructure And Service Projects

The Middle East has been focusing on infrastructure. Roads, hospitals, and schools are developing fast. Public-private partnerships push these advances.- Better facilities: Citizens enjoy improved services.

- Job creation: New projects mean more work.

- Growth: It helps the entire economy to grow.

Financing Mechanisms And Outcomes

Funding large-scale projects is complex.| Mechanism | Description | Outcome |

|---|---|---|

| Bonds | Debt securities are issued. | Long-term investment returns. |

| Loans | Banks provide large loans. | Immediate project funding. |

| Equity | Partners buy project shares. | Shared project ownership. |

Demographic Shifts And Their Economic Impact

Youth Population Surge

A youthful demographic bulge stands ready to reshape the market. Countries attract young talent. They build a vibrant consumer base. This group is tech-savvy. They are ready to spend. Companies eye this demographic. They see future customers.- Rising demand for goods and services

- Technology adoption at its peak

- Entrepreneurship thrives among young people

Expat Influence And Talent Attraction

Expats reshape economies. They bring skills. They bring expertise. Countries in the Middle East recognize this. They create policies to attract these professionals. This strategy diversifies the workforce.| Policy Impact | Economic Benefit |

|---|---|

| Visa Reforms | Attract global talent |

| Tax Incentives | Stimulate business investments |

| Cultural Openness | Enhance social harmony |

Leveraging Expo And World Events

Global Recognition And Branding

Being in the global spotlight changes everything. The Middle East country leveraging expos catches the eye of the world. The nation’s image and offerings beam across continents through these events. Here’s how global recognition will elevate it to a prime spot in international trade.- Brand Visibility. Expos cast a spotlight, enhancing the country’s brand on a vast scale.

- Cultural Exchange. Sharing culture fosters understanding and opens doors to trade.

- Media Coverage. The press circulates the country’s stories, reaching investors far and wide.

Business Opportunities And Networking

A hub for high-level connections forms as business pioneers gather at world events. This Middle East country will emerge as a buying power. Let’s delve into the networking cornucopia it will harvest.| Event | Opportunities | Networking Benefits |

|---|---|---|

| Expos | New partnerships | Meeting global leaders |

| Conferences | Innovative technologies | Cross-industry connections |

| Seminars | Investment prospects | Diverse business insights |

Sustainability Goals And Green Initiatives

Environmental Policies

The region has introduced comprehensive environmental policies that support their sustainability mission. These policies aim to reduce carbon footprints and encourage greener practices across industries. They include regulations on waste management and incentives for businesses to go green. Such shifts spell out a clear message: the Middle East is a future hub for eco-innovation.Renewable Energy Projects

Countries in this region are not just talking the talk; they’re walking the walk with renewable energy projects. Solar and wind energy are at the forefront of this transition. The sun drenched deserts and high wind areas are perfect for harvesting natural energy. This shift not only helps the planet but also diversifies their economies. Here’s a glance at their renewable ventures:- Solar power plants that turn sunny days into clean energy.

- Wind farms that capture the breezy whispers of the desert.

- Smart grids that manage energy flow efficiently.

Looking Ahead: Vision 2030 And Beyond

Strategic Economic Diversification Plans

Middle Eastern nations are crafting strategic economic diversification plans to broaden their markets. Focused on reducing their reliance on oil, these countries are investing heavily in sectors like tourism, renewable energy, and technology.- Technology advances drive efficiency and innovation.

- Renewable energy projects attract global investment.

- Tourism initiatives aim to draw visitors worldwide.

| Sector | Goals by 2030 |

|---|---|

| Renewable Energy | 25% of overall energy mix |

| Tourism | Triple the current visitor volume |

| Technology | Leader in AI and smart infrastructure |

Benchmarking Success And Adjusting Strategies

To ensure success, Middle Eastern nations are setting clear benchmarks. Constantly reviewing progress, these countries adjust strategies to meet their ambitious targets.- Setting clear, measurable goals.

- Regularly tracking progress against these targets.

- Adjusting plans to address emerging challenges and opportunities.

Frequently Asked Questions For Middle East Country Will Be The Big Volume Buyer

Which Middle East Country Is The Top Importer?

Saudi Arabia often leads as a major importer in the Middle East due to its robust economy and market size.

What Commodities Does The Middle East Import?

The Middle East primarily imports machinery, electrical equipment, cars, foodstuffs, and pharmaceuticals.

How Does Oil Wealth Influence Middle East Imports?

Oil wealth enables Middle East countries to fund large-scale imports, improving infrastructure and boosting consumer markets.

Which Sector Sees The Highest Middle Eastern Demand?

The construction sector often sees heightened demand in the Middle East, particularly for infrastructure and development projects.

How Will Middle East Import Trends Evolve By 2023?

Shifts towards diversification and sustainability may alter import trends, favoring green technology and renewable energy sources.

What Impacts Middle East Import Volumes?

Economic growth, diversification efforts, and regional stability significantly impact Middle East’s import volumes.

Who Are The Middle East’s Main Trade Partners?

Key trade partners include China, the EU, India, and the United States, fostering a dynamic global trade environment.

How Do Middle East Imports Affect Global Markets?

Middle East imports can create substantial demand, influencing global commodity prices and production cycles.

What Role Does Technology Play In Middle East Imports?

Technology adoption drives efficiency and growth in various sectors, leading to increased demand for high-tech imports.

Can Middle East’s Import Activity Influence Oil Prices?

Yes, robust import activity may indicate economic strength, potentially affecting oil demand and subsequently oil prices.

Conclusion

As the facts stand, the Middle East is poised to dominate as a principal purchaser in the global market. This shift signals a dynamic era for international trade. Key stakeholders should consider the strategies and potential outcomes highlighted throughout this discussion.

The region’s burgeoning appetite for commerce underscores its ascent as a formidable buying powerhouse. Recognizing this trend is vital for businesses aiming to capitalize on emerging opportunities.